Safaricom Cites CRB Key Factor for Fuliza Limit 2 Years after Removing 4m Kenyans from Blacklist

- In October 2022, Safaricom PLC removed 4.6 million Kenyans from a negative credit score list by the Credit Reference Bureau (CRB)

- An M-Pesa customer raised concerns online over the zero Fuliza loan limit, since he started using Safaricom services

- The leading telecommunications firm explained to TUKO.co.ke that the overdraft facility limit can be determined by a customer's Credit Reference Bureau (CRB) status

Wycliffe Musalia has over six years of experience in financial, business, technology, climate, and health reporting, providing deep insights into Kenyan and global economic trends. He currently works as a business editor at TUKO.co.ke.

Safaricom PLC has explained why most Fuliza customers have zero limits despite using the SIM cards for more than six months.

Source: Facebook

There have been various concerns from different customers complaining of zero limits.

What determines Fuliza limit allocation?

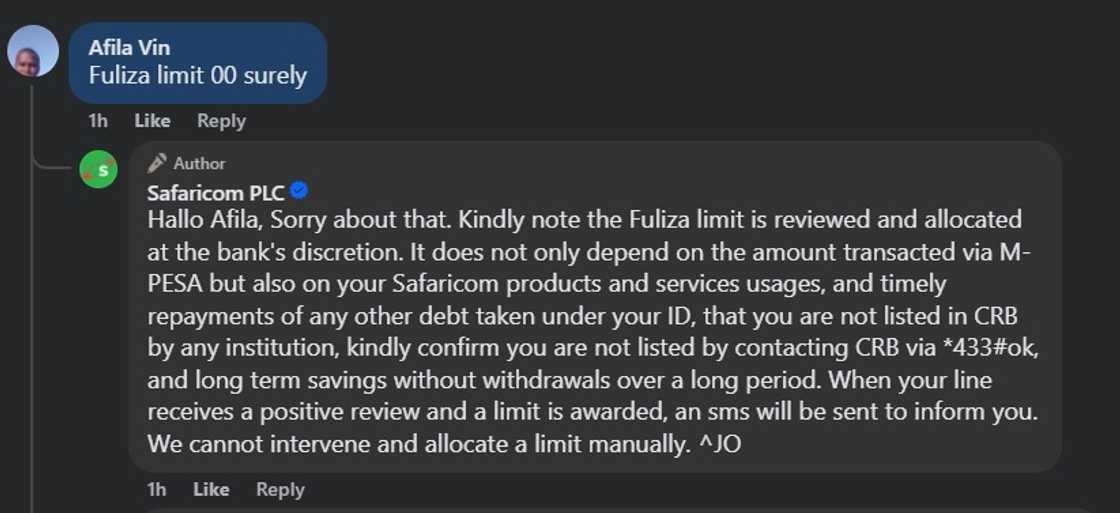

An M-Pesa customer took to the comments section of a Safaricom Facebook post, asking why his Fuliza remained zero.

"Fuliza limit 00 surely," the customer wrote.

In response, the telecommunications firm said the Fuliza limit does not only depend on the amount transacted via M-Pesa, usage of Safaricom products and services, but also on timely repayments of any other debt taken under your national ID.

"Kindly confirm you are not listed on CRB. When your line receives a positive review, a limit will be awarded. We cannot intervene and allocate a limit manually," said Safaricom.

Source: UGC

Speaking exclusively to TUKO.co.ke, Safaricom explained that Fuliza loan limit depends on a customer's credit score.

The telco said the score is determined by Credit Reference Bureau's, which allocates the score.

"Customer CRB status is one of the factors considered in Fuliza limit adjustment. In addition to this, a customer needs to increase savings (in M-Shwari and KCB-M-Pesa), and repay loans on time," said Safaricom.

This came after the company removed Fuliza customers who had defaulted from CRB blacklist in October 2022.

Safaricom CEO Peter Ndegwa noted that the move was facilitated by Kenya Commercial Bank (KCB) and NCBA bank, which offer the service via the telco.

Steps to grow Fuliza loan limit

Safaricom shared steps M-Pesa customers should take to increase their Fuliza limit.

The company warned customers against opting in and out of the overdraft facility, noting that the move could lower the limit to zero.

The steps include:

- Using Fuliza frequently for small transactions

- Repaying the loan balance on time

- Avoiding overdue balances

- Save regularly without withdrawing

- Repaying Okoa Jahazi debt on time

- Keeping the M-Pesa line active and utilising other services.

The telco called for strict adherence to these steps to achieve the desired Fuliza limit.

Fuliza is an overdraft facility available for all Safaricom M-Pesa customers, but not all users are eligible for a loan limit upon activation.

What to know about Fuliza

- A customer with a Fuliza debt older than three months cannot access the remaining balance until it is fully paid.

- Safaricom revealed that customers seeking to access their Fuliza balance should dial USSD code *334#.

Proofreading by Jackson Otukho, copy editor at TUKO.co.ke.

Source: TUKO.co.ke